Time is of the essence when it comes to month-end, as every minute spent reconciling financials and tracking down data is time not spent on revenue-generating work. Even worse, the entire process can be slow and painful if your agency is stuck with manual records or poor data visibility. But fear not! We’ve compiled an easy-to-follow checklist to help you streamline your agency’s month-end process.

What Makes Month-End So Challenging?

First, if you don’t have the right information in an easily accessible place – this can be a lack of centralized data or discovering errors in manual records. Or, you might have difficulty in getting a clear view of the status of all current projects, resulting in poor data visibility. If you’ve been using inconsistent standards for reporting, that might result in inaccurate revenue forecasting, which will also make the month-end process difficult.

Benefits of Streamlining the Month-End Process

Of course, streamlining month-end tasks improves efficiency. Additional benefits include knowing your data is accurate and that your financial records are up to date, making it more straightforward to make informed decisions based on your agency’s financial health. Overall, a complete process reduces risk, results in better cash flow planning, and highlights areas that require improvement.

How to Speed Up Your Agency’s Month-End

Here are some quick tips to help you speed up the month-end process:

- Improve real-time visibility and accuracy with centralized data, so you’re not manually moving spreadsheets from one system to another.

- Streamline collaboration, making it easy to see current project status and track hours worked.

- Automate workflows to reduce manual tasks like invoicing clients for completed work.

- Implement a standardized checklist so that you don’t miss any critical steps in the process.

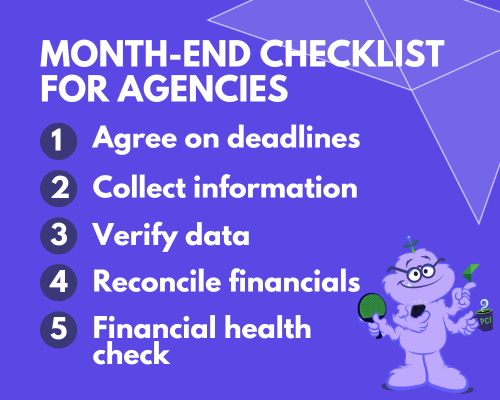

Agency Month-End Checklist

Speaking of checklists, here’s your month-end checklist to help you tackle the month-end process with greater speed and efficiency.

- Agree on deadlines – Ensure that all departments are on the same page about when timesheets and status reports are due so that you have all the information needed at the right time.

- Collect information – Pull together reports on the status of current projects and check that any outstanding invoices have been sent to clients.

- Verify data – Once you have all the data, verify that the information is correct for accurate revenue recognition. Cross-check bank statements with your financial reports.

- Reconcile financials – Update your accounts receivable and accounts payable, reconcile the records with your bank accounts, and check for errors.

- Financial health check – Once all your finances are reconciled, it’s time to look at the results. Compare your actuals with your budget and review your cash flow statement and balance sheets. If your revenue forecasting was off, investigate the cause to prevent any financial hiccups in the future.

- Bonus tip – Remember that accuracy is more important than speed!

Simplify the Process with the Right Agency Accounting Software

If the checklist above still seems daunting, it’s time to consider leveraging technology to automate part of the process. Deltek WorkBook is the leading agency management system with robust financial management tools to help with everything from revenue forecasting to timesheets. Check out our on-demand webinar, “How Deltek WorkBook Can Be Utilized To Streamline Your Month-End Process.”

Want to learn more? Our agency industry experts at PCI would be happy to discuss how to tailor the tools available within Deltek WorkBook to fit your specific needs. Contact us for more information or to schedule a demo.